low closing cost refinance insights for today

What it means

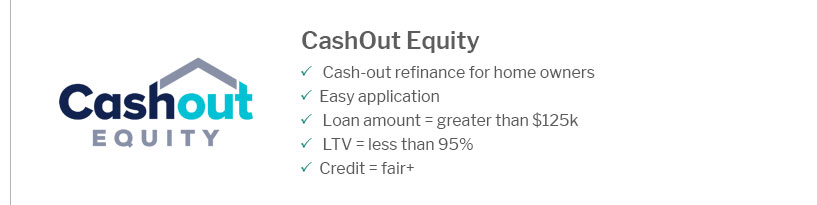

A low closing cost refinance aims to minimize upfront fees when replacing your mortgage. Instead of paying thousands at the table, borrowers may use lender credits or roll costs into the loan, often in exchange for a slightly higher rate. This can preserve cash for emergencies, renovations, or debt payoff while still lowering monthly payments.

When it can make sense

It’s useful if you expect to move sooner, need liquidity now, or the rate drop is meaningful even after credits. Be mindful: “no-cost” rarely means free; costs are redistributed. Calculate your breakeven and compare the lifetime interest to ensure the trade-off aligns with your goals.

What to compare

- APR vs rate: captures credits and fees.

- Lender credits: how much for each rate step.

- Term options: 30 vs 20 vs 15 years.

- Lock period: long enough for underwriting.

- Prepaids and escrows: what’s refundable.

Quick tips

Shop at least three lenders, request a standardized Loan Estimate, keep credit scores stable, and ask about par rates, discount points, and appraisal waivers to strike the right balance of cost and savings.